Mexico Shows Link Flamenco Spirit to Chavela Vargas’ Ranchera Heritage

Guitarricadelafuente, the Spanish singer who blends flamenco and folk with modern ache, returns to Mexico this November—not just to perform, but to pay homage to the rancheras that shaped his sound long before streaming ever crossed the Atlantic.

A Childhood Scored by Mexican Voices

In the seaside town of Benicàssim, long before anyone called him Guitarricadelafuente, Álvaro Lafuente sat cross-legged by his family’s stereo listening to Chavela Vargas, José Alfredo Jiménez, and Los Panchos.

“Mexico’s influence was huge,” he told EFE in Mexico City, eyes lighting up as he remembered the records that looped through his childhood home. “They made me want to pick up a guitar.”

The melodies seeped into his fingers. Even as his career took off in Spain, those early voices never left. On his debut album La cantera, Lafuente laced Andalusian tremolos with rhythmic shadows of Veracruz, drawing an invisible thread across the ocean.

He describes the bond between Spanish flamenco and Mexican ranchera not as fusion, but as recognition. “There’s a shared grief, a shared celebration,” he says. “Mexican audiences feel flamenco in their bones. And for me, rancheras feel like home.”

As he prepares to take the stage in Guadalajara, Mexico City, Puebla, and Monterrey, the tour feels less like a debut and more like a homecoming—long overdue, but perfectly timed.

The Art of Holding Back

Lafuente’s newest album, Spanish Leather, is a lesson in restraint.

Gone are the thick layers of harmonies, the ornate production, the urge to fill every silence. In their place are grainy vocals, bare-boned guitar, and intimate spaces where lyrics can breathe.

“These songs didn’t need jewelry,” he said. “They needed clothes that fit.”

The album was recorded in the United States with musicians who didn’t speak Spanish. At first, he found that strange. But soon, the sessions revealed something he hadn’t expected.

“They listened harder,” he said. “Without understanding the words, they caught the emotion.”

The minimalism, he believes, pays a quiet tribute to the ranchera masters he has always admired. “José Alfredo could silence a bar with three chords and an open throat,” Lafuente said. “I wanted that honesty.”

You hear it in tracks like “Caballito” and “A cuerpo gentil”—songs that linger like cigarette smoke after a midnight confession. They’re not designed for radio rotation; they’re built for moments of stillness, for listeners who want to lean in rather than dance out.

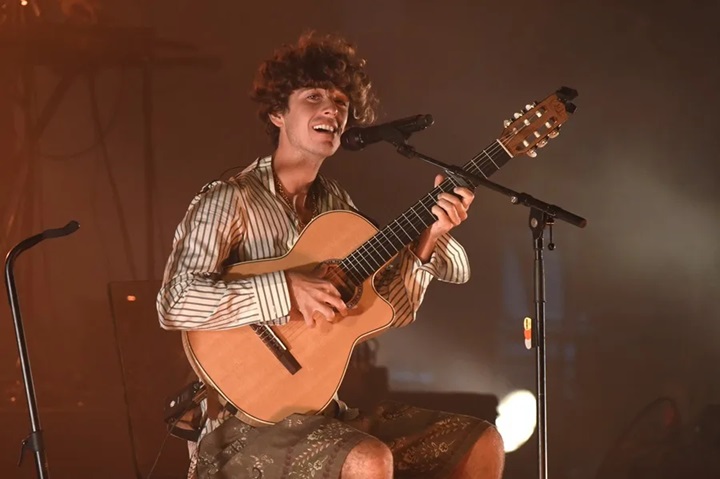

EFE / Javier Blasco

A Bigger Stage—and a Wider Lens

Lafuente’s voice may be grounded in tradition, but it’s found unlikely pathways into global playlists.

A duet with Troye Sivan and the placement of his song “Conticinio” in an Apple ad starring Pedro Pascal pushed him into the ears of those who had never heard of Benicàssim or Ciudad Juárez. Suddenly, his ballads were sitting alongside pop and hip-hop, not buried in “World” or “Latin” categories.

And that, to him, matters.

“Spanish-language music isn’t just ‘Latin’ anymore,” he said. Audiences are open to whatever moves them. The walls between genres, even between countries, are crumbling.”

That openness paved the way for this fall’s tour, which includes stops at Teatro Estudio Cavaret in Guadalajara, Auditorio BB in Mexico City, Tecate Comuna Festival in Puebla, and Escenario GNP Seguros in Monterrey.

Each venue is different. But the promise is the same: a chance to return the music to the land that first taught him how to feel it.

From Guitar Strings to Movie Scripts

While rehearsing for the tour, Lafuente also found himself in a different kind of spotlight—his first acting role, in a film by Los Javis, the acclaimed Spanish directors behind Veneno and La Mesías.

The film, La bola negra, is a loose adaptation of an unfinished play by Federico García Lorca, weaving three stories of identity and desire across time.

Accepting the lead role felt like an extension, not a detour.

“When I sing, I’m telling a story that’s not entirely mine,” he told EFE. “Acting felt like the same thing—just with different clothes.”

Reading the script while recording Spanish Leather, Lafuente noticed echoes between the characters’ longing and his lyrics. “It helped me connect more deeply to what I was already trying to say with the music.”

The jump from music to cinema didn’t come with ego or reinvention. Instead, it felt natural—another form of storytelling for someone who’s never separated the art from the feeling.

Backstage, he’s still the same songwriter scribbling in hotel rooms, drawing inspiration from fandangos and corridos, from flamenco and bolero, from anything that pulses with human vulnerability.

When the lights dim this November and Lafuente steps on stage, something circular will unfold. The songs shaped by Mexican voices will return to the soil they came from—not as mimicry, but as conversation.

And in the pauses between verses, in the hum of nylon strings and the hush of a listening crowd, you’ll hear what happens when a Mediterranean shore dreams of mariachi, and a boy raised on rancheras finally brings the music home.

Also Read: Latin American Hit List 2025: Billboard’s Top 25 Songs Revealed

Credits: Based on interviews with Álvaro Lafuente (Guitarricadelafuente) and reporting by EFE; tour information provided by venue press offices in Guadalajara, Mexico City, Puebla, and Monterrey; music analysis by independent Spanish folk critics; film context from producers Javier Ambrossi and Javier Calvo (“Los Javis”).