Mexico and Brazil: Global Leaders in Metal Foundry Industry

Mexico and Brazil have emerged as leading forces in the global metal foundry industry, securing their positions despite the economic challenges posed by the COVID-19 pandemic. Both countries have demonstrated resilience and growth, with Mexico leveraging nearshoring opportunities to accelerate its industrial expansion.

Mexico and Brazil, two of Latin America’s largest economies, have positioned themselves as key players in the global metal foundry industry. Despite the severe economic challenges brought on by the COVID-19 pandemic, both nations have managed to maintain and expand their production capacities, contributing significantly to the global supply of cast metals.

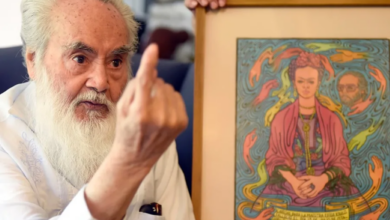

According to Jorge Vázquez Lujano, Director of Global Sales at the Mexican company Fundiciones Nardo, the pandemic presented a formidable obstacle for the industry. “The situation for the industry was very complicated,” Vázquez Lujano explains, noting the declines experienced during this period. However, the resilience of Mexico and Brazil’s metal foundry sectors has been notable, with both countries continuing to hold their ground as leading producers of molten metals.

The metallurgical sector is a cornerstone of Brazil’s productive industry. Data from the National Confederation of Industry (CNI) in Brazil reveals that this sector employs nearly 230,000 people across approximately 3,000 companies and contributes 3.1% of the nation’s industrial GDP. This impressive output underscores the importance of the metal foundry industry to Brazil’s broader economy.

Similarly, Mexico’s foundry sector is set to experience a significant growth spurt, with projections indicating a 3% increase by 2024. This growth is primarily attributed to nearshoring, where companies relocate production closer to their primary markets to reduce costs and improve supply chain efficiency. The nearshoring trend has already driven $1.8 billion in investments into Mexico’s foundry industry, comprising around 1,000 companies.

Bruno Jaramillo, General Director of the Mexican Foundry Society (SMFAC), highlights the transformative impact of nearshoring on the industry. “Thanks to nearshoring, the foundry industry achieved its investment goal of $1.8 billion, originally planned for 2026, ahead of schedule. Now, we project an additional increase of up to 50%,” Jaramillo notes. He emphasizes that the metal foundry industry forms the backbone of the entire manufacturing supply chain in Mexico, creating over 65,000 direct jobs and another 205,000 indirect jobs in both ferrous and non-ferrous products.

A significant portion of this production, approximately 63%, supports the automotive industry, which remains a critical sector in Mexico’s economy. The country’s ability to sustain such a high production level during a global pandemic is a testament to the industry’s robustness and vital role in the manufacturing sector.

Emphasizing Employment and Competitiveness

However, challenges remain as the metal foundry industry in Mexico and Brazil continues to grow. One pressing issue is the shortage of specialized labor, mainly engineers and technicians in mechatronics. Jaramillo warns of a 62% deficit in specialized personnel, a gap the industry must address to sustain its growth trajectory. “We are actively seeking to create new cadres of specialists for this industry,” he states, acknowledging the need for more targeted education and training programs.

This shortage is not unique to Mexico; it is a challenge across Latin America. The underrepresentation of women in STEM (Science, Technology, Engineering, and Mathematics) careers further exacerbates this issue. Only about two to three of every ten engineers are women in Mexico and Brazil. This statistic is echoed in Latin American countries, such as Chile and Colombia, where women also comprise around 30% of the engineering workforce. These figures, provided by the University of Zulia in Venezuela, highlight a critical need for more inclusive educational policies to encourage greater female participation in STEM fields.

Vázquez Lujano also points to another significant challenge: the fierce competition from countries like China, Turkey, and India. These nations often offer metal foundry products at prices up to 30% lower than those of Mexican producers, posing a threat to Mexico’s market share. However, Mexico holds a competitive advantage in terms of delivery times. “While it takes six to eight months on average for products from these countries to reach their destinations, Mexican foundries can deliver in approximately two months,” Vázquez Lujano explains. This faster turnaround gives Mexico a distinct edge in the global market, particularly for clients prioritizing speed and reliability.

Navigating Global Competition

To further enhance the competitiveness of Mexico’s metal foundry industry, Vázquez Lujano stresses the importance of global networking events, such as FundiExpo. Scheduled to take place from October 16 to 18 in Mexico City, FundiExpo will bring together over 350 companies worldwide. Such events are crucial for showcasing the capabilities of Mexican foundries, fostering international partnerships, and discussing the latest innovations and challenges in the industry.

As Mexico and Brazil continue to dominate the global metal foundry industry, their ability to navigate and overcome challenges will be critical to their success. The pandemic has underscored the importance of resilience and adaptability in adversity. The road ahead may be fraught with obstacles for these two Latin American giants, but the opportunities for growth and leadership in the global market remain vast.

Both countries have proven that, even in the most challenging times, their metal foundry industries are essential to their national economies and integral to the global supply chain. With continued investment in technology, education, and international collaboration, Mexico and Brazil are well-positioned to maintain their leadership roles and drive the future of the metal foundry industry forward.

Also read: Starlink’s Rise in Mexico: How Government Contracts Fuel Growth

As the world emerges from the pandemic, the lessons learned by Mexico and Brazil’s foundry sectors could serve as a blueprint for other nations looking to strengthen their industrial capabilities. The resilience and strategic foresight demonstrated by these countries have set them apart, ensuring they remain at the forefront of global metal production for years.